What Exactly is the Apple Credit Card and Do I Need One?

Like it or not, the Apple Card is officially here. I recently took a deep dive into the card and discovered where it’s awesome and where it falls short. From security measures, to cashback features, to debt management tools and a cool design, I looked at it all. I hope this review helps you decide if the Apple credit card belongs in your wallet or on your iPhone.

What Exactly is the Apple Credit Card?

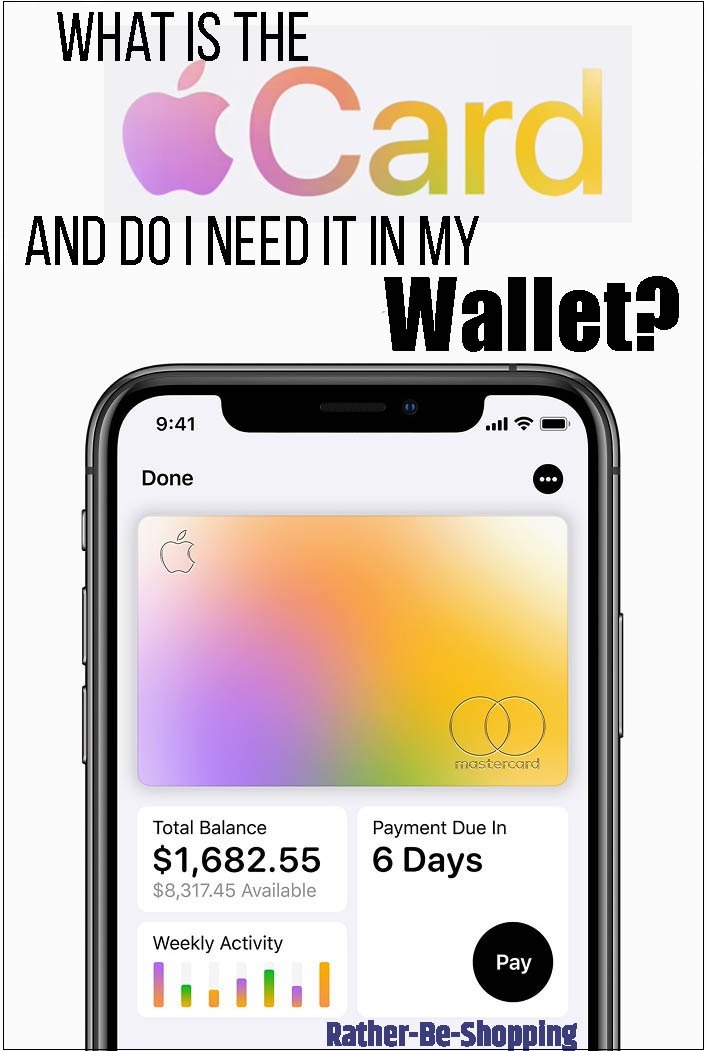

Back in August of 2019, Apple rolled out the Apple Card, a credit card that’s linked directly to Apple Pay.

The card is backed by Goldman Sachs (and MasterCard) and is designed to seamlessly work with your iPhone and Apple Pay.

But you don’t need to use Apple Pay to use the card, but you’ll want to, more on that later.

You can use the card to make digital Apple Pay payments with your iPhone OR you can use it like you would any plastic credit card in your wallet.

The card also boosts strong security measures. These include FaceID, TouchID, and unique transaction codes.

So…Does Apple Actually Mail Me a Card?

Yes.

In addition to being able to use the card directly from your iPhone, Apple will mail you an actual credit card made out of 100% titanium. Yes, you read that correctly.

Besides being made out of titanium, the card has some other cool features too.

The card only has your name on the front and a magnetic strip on the back…that’s it.

There’s no card number or CVV number anywhere which keeps people from stealing your information when you’re not looking.

Is There An Annual Fee or Hidden Fees?

The card does NOT have an annual fee or any hidden fees.

There also is NO foreign transaction fee or late penalty.

Be aware that instead of charging you a late penalty/fee, Apple will charge you “additional interest” instead.

See Also: Apple Employee Discount: Is It Good Enough to Apply for a Job?

How Exactly Do I Use the Card?

You can use the credit card in 1 of 2 ways:

- Apple Pay: This is when you link the card to your iPhone via the Wallet app that comes already installed on all iPhones. You just use your iPhone to complete purchases like in the picture above.

- Non-Apple Pay: If the store or business doesn’t accept Apple Pay then you just use your titanium card and complete your purchase like you would with a traditional credit card.

Not all merchants accept Apple Pay so it’s smart to have the actual credit card on you at all times.

According to MacRumors, as of early 2019, “Apple Pay was available in 65 percent of U.S. retail locations. 74 of the top 100 merchants in the United States accept Apple Pay.”

What APR Can I Expect?

Depending on your credit rating, your card will come with an APR between 13.24% to 24.24%.

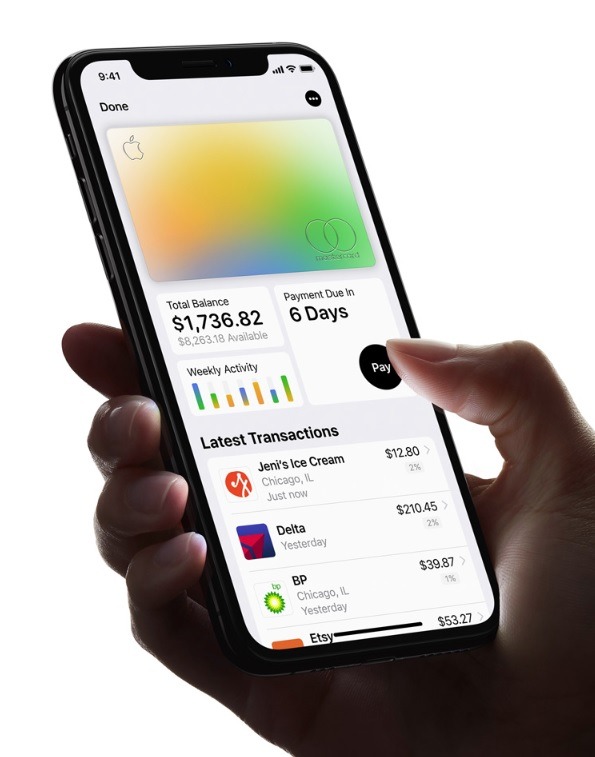

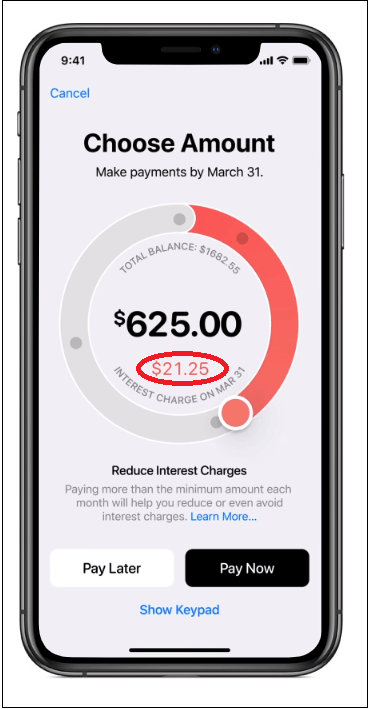

As with any credit card, interest charges can add up quickly. To help you realize this, Apple shows you EXACTLY how costly it is to carry a balance on your card.

Specifically, “When you’re ready to make a payment, Apple Card estimates the interest you’ll wind up paying, based on any payment amount you choose.”

Seeing the numbers in black and white should help many shoppers realize how their spending habits influence their finances every month.

How Does It Help Me Control My Spending?

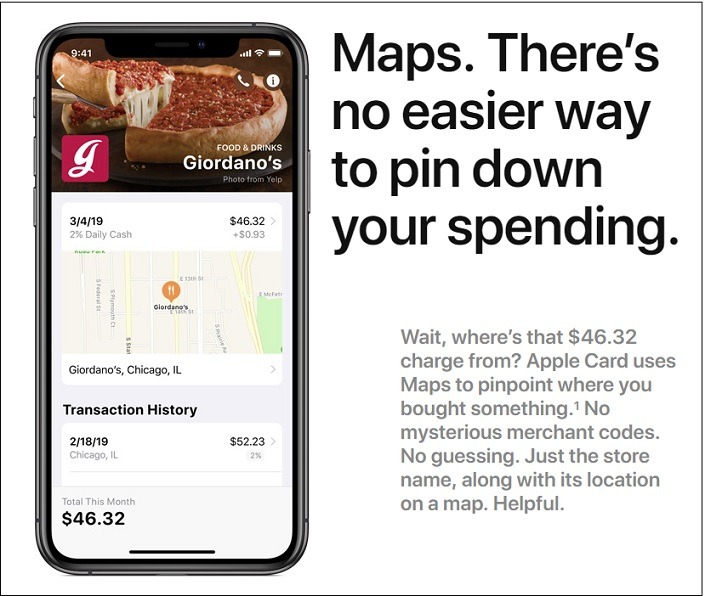

All Apple Pay transactions are linked to Apple Maps within your iPhone which allows you to quickly see exactly where you made your past purchases.

This is a really handy tool for shoppers who tend to overspend and not keep a tally of their credit card purchases.

Think of it as an easy-to-follow “history” of your recent purchases.

The Wallet app also breaks down your purchases by type and color codes them accordingly. Think entertainment, food, shopping, and travel.

You then get a snapshot within the app of where you tend to spend your money and your “virtual card” actually turns the color of whatever you spend the most on.

Where your card looks like rainbow sherbet you know your spending is balanced.

Apple is trying to make it easier for you to see what types of purchases you might want to cut back on. At least that’s how I would use the information.

See Also: Are You a Vet? The Apple Military Discount is Worth Knowing About

What are the Requirements to Qualify for the Apple Card?

You must be at least 18 years of age and a legal U.S. citizen.

When applying, Apple will ask for the following:

- First and last name.

- Date of birth.

- Phone number.

- Home address.

- Country of citizenship.

- Last four digits of your Social Security number.

- Your annual income.

Apple also reserves the right to ask for a picture of your driver’s license or state ID card.

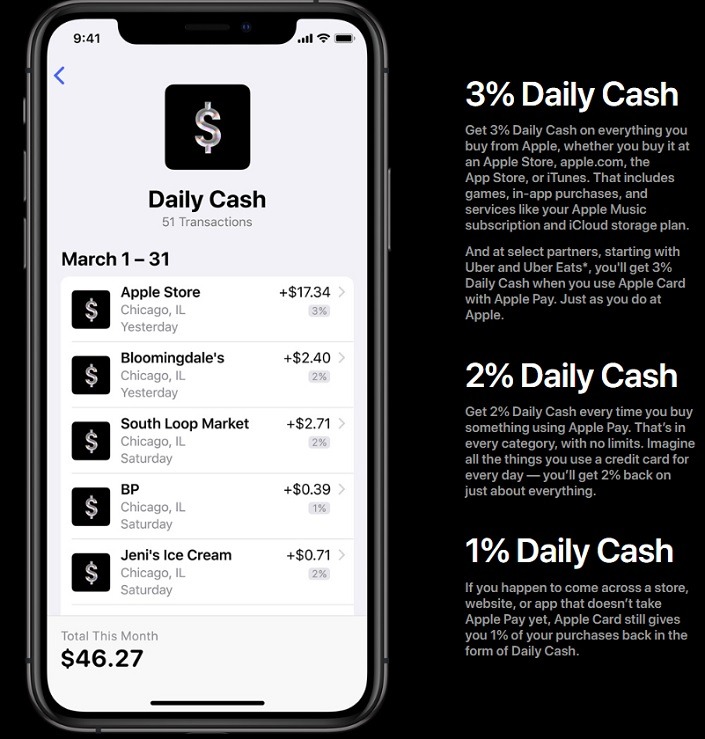

Does the Card Offer Cashback Rewards?

Yes, and they’re not to shabby.

You get 3% back on everything you buy from Apple, 2% back on all Apple Pay purchases, and 1% back on all purchases where Apple Pay is NOT accepted.

Not as good as some “rewards” credit cards, but not terrible either.

The coolest perk of their rewards system is “Daily Cash”. Daily Cash is essentially Apple’s way of giving you cash rewards on a daily basis rather than making you wait for your monthly statement.

Cash you can use right away on your next purchase via Apple Pay.

Just make sure you sign-up for Apple Cash as that’s the only way for you to collect your “Daily Cash”.

Without Apple Cash setup, you’ll have to wait for your monthly statement to collect your cash-back.

The amount of cash-back available is unlimited and can also be transferred to a friend with an iPhone, used to pay off your credit card bill, or it can be transferred to your bank account.

How Do I Make “Non” Apple Pay Purchases?

You just use the titanium card that Apple sends you in the mail like you would a normal credit card.

You can use it anywhere MasterCard is accepted.

The one downside is you’ll only get 1% cashback on these purchases instead of 2% when using Apple Pay.

What Will My Credit Limit Be?

It depends on your annual income and credit score.

Typically the better your credit score, the higher your credit limit will be.

FYI: Some people with a credit score as low as 620 are getting approved. (Source)

How Do I Make My Payments?

This is where the card is kinda awesome, not gonna lie.

You make your payment via the Wallet app on your iPhone. (see pic above)

To get started, you first have to add a bank account. The first time you choose to add a bank account you’ll be asked if you want to use the same account you use with Apple Cash.

If you select “Yes” then you’ll be good to go, otherwise you’ll have to follow the prompts to link your bank account.

You’ll also get notifications on your iPhone when your payment is coming due so you never miss it.

But the really cool part is how the Wallet app shows you how much interest you’ll pay if you don’t make the full payment.

It’s a great reminder how interest builds up and totally sucks.

Here’s a screenshot of what I am talking about:

So…What’s the Final Verdict?

Let’s break it up by pro’s and con’s to help you decide if the card is right for you.

Pros:

- Strong security features

- No fees

- Unique titanium card design

- Easy to use debt management tools

- Seamless integration with Apple Pay

- Daily cashback

And of course some of the negatives:

Cons:

- No welcome bonus

- Requires Apple technology and hardware

- Low 1% cashback on non Apple Pay purchases

- No introductory low APR for purchases and balance transfers

- Dependent on Apple Pay sticking around

If you’re an Apple fan-boy (or girl) you probably don’t care about the cons but they’re definitely significant and should be taken into account.

Ask the Reader: What’s in your wallet? Is it the titanium Apple card? If so, how do you like it so far?

By Kyle James

Screenshots courtesy of Apple.

I started Rather-Be-Shopping.com in 2000 and have become a consumer expert and advocate writing about out-of-the-box ways to save at stores like Amazon, Walmart, Target and Costco to name a few. I’ve been featured on FOX News, Good Morning America, and the NY Times talking about my savings tips. (Learn more)